Billing and Payment Feedback Template: Simplifying Financial Transactions

In today’s fast-paced world, managing finances efficiently is crucial for both businesses and individuals. One way to streamline this process is by utilizing well-designed financial forms and feedback systems. These tools not only simplify financial transactions but also provide valuable insights for improvement.

In this article, we will explore the importance of a billing and payment feedback template, how it enhances financial interactions, and how to create an effective one.

The Role of Financial Application Forms

Financial application forms are essential tools for collecting accurate information from clients or customers. They ensure that all necessary details are captured, reducing the chances of errors and misunderstandings.

A well-structured financial application form can expedite the approval process, making it easier for applicants to access financial services quickly.

Importance of Finance Forms in Transactions

Finance forms, such as billing forms and payment request forms, are integral to the financial transaction process. They provide a standardized format for recording financial data, which is crucial for both accounting and auditing purposes. Using these forms ensures consistency, accuracy, and transparency in all financial dealings.

The Power of Feedback Post-Transaction

Collecting post-transaction feedback right after a transaction gives businesses timely insights into customer satisfaction, helping to quickly address issues and improve service.

1. Enhancing Customer Experience

Feedback post-transaction is a valuable tool for improving customer satisfaction. After a financial transaction is completed, soliciting feedback can help identify areas of improvement and simplify the transaction process. This feedback can be gathered using program survey templates, which are designed to be user-friendly and comprehensive.

2. Benefits for Businesses

For businesses, feedback from customers can highlight pain points in the billing and payment process. By addressing these issues, companies can enhance their services, leading to increased customer loyalty and retention. Additionally, positive feedback can serve as testimonials, attracting new clients.

Creating an Effective Billing and Payment Feedback Template

An effective billing and payment feedback template ensures that customers can easily share their experiences, allowing businesses to optimize their payment processes and resolve concerns.

Key Elements of a Feedback Template

- Clear Instructions: Ensure that the instructions are easy to understand. This helps respondents provide accurate and useful feedback.

- Relevant Questions: Include questions that are directly related to the financial transaction. Avoid unnecessary questions to keep the survey concise.

- Rating Scales: Use rating scales to quantify feedback. This makes it easier to analyze and identify trends.

- Open-Ended Questions: Provide space for respondents to elaborate on their experiences. This can reveal insights that might be missed in structured questions.

- Contact Information: Offer an option for respondents to provide their contact information if they wish to be contacted for further clarification.

Example of a Billing and Payment Feedback Form Templates

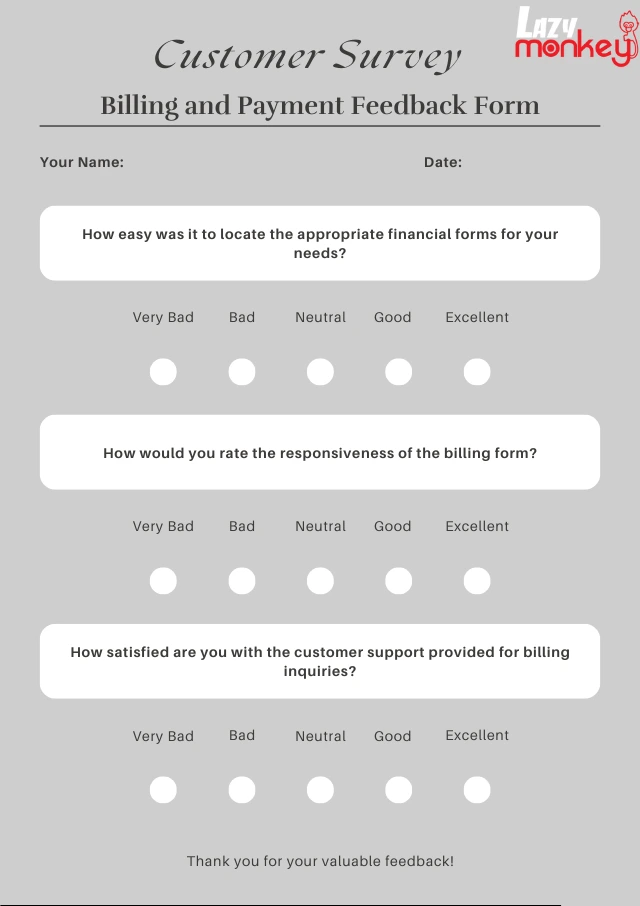

Example.1

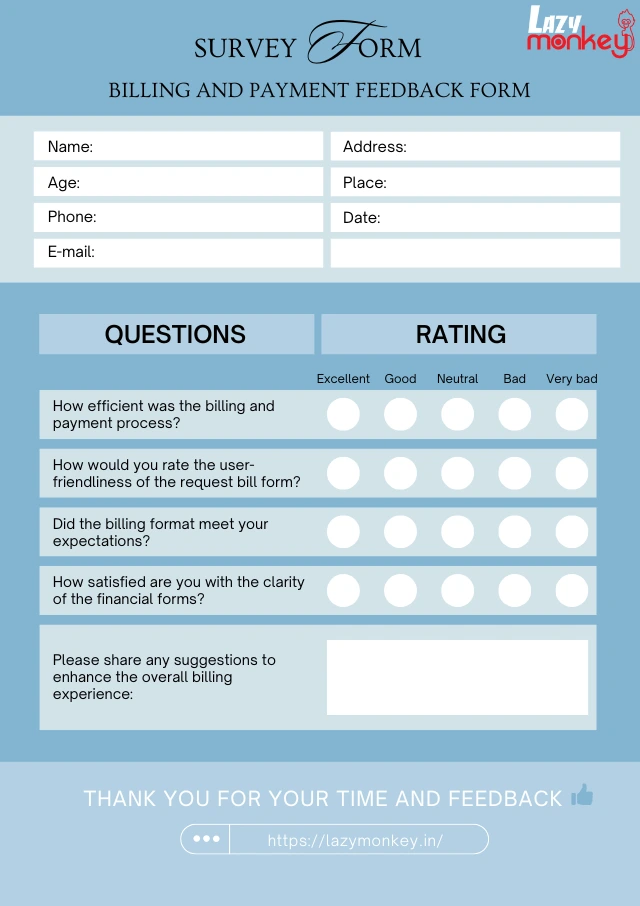

Example.2

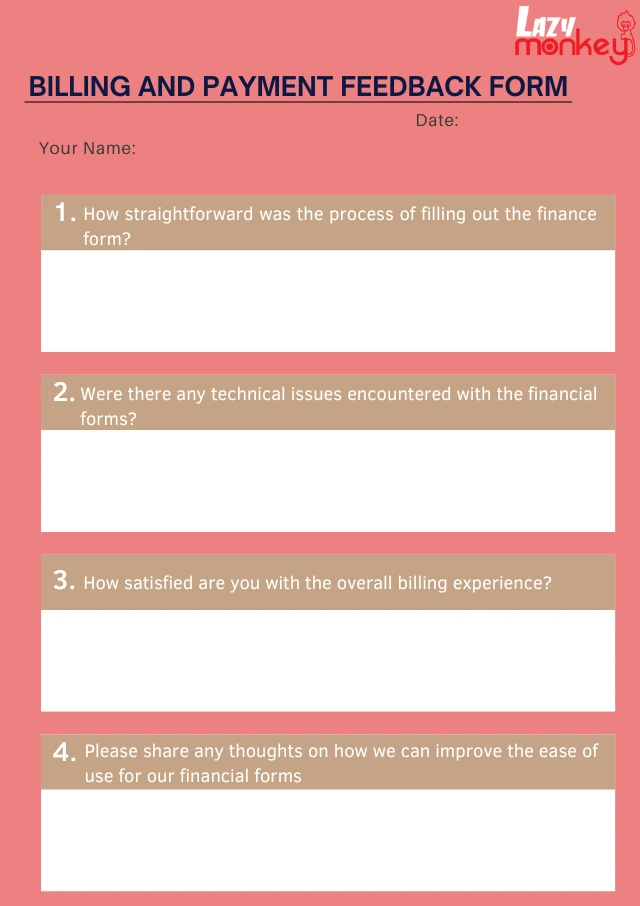

Example.3

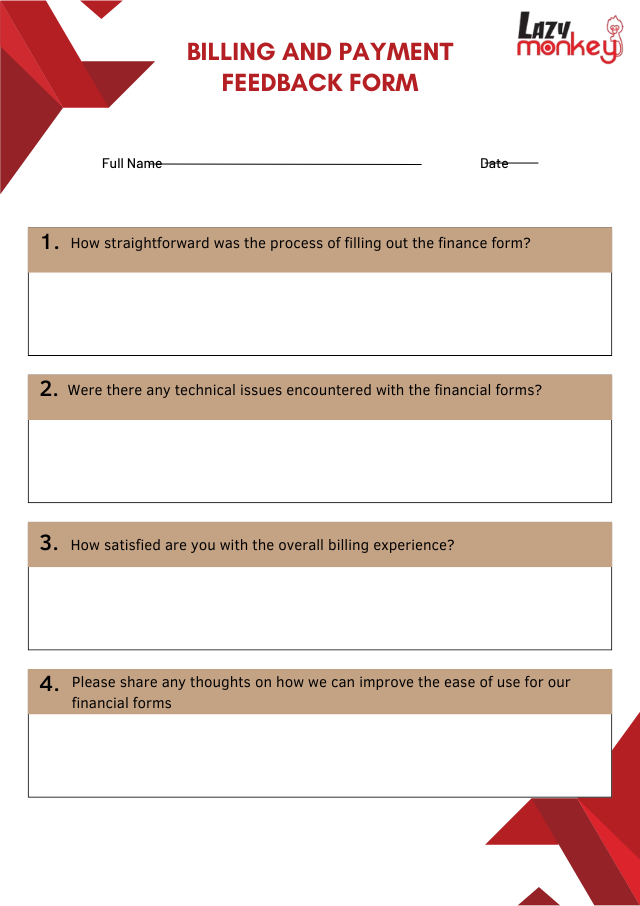

Example.4

Implementing the Feedback

Turning customer feedback into action is key to improving products, services, and overall satisfaction. By addressing concerns, businesses can drive growth and foster loyalty.

1. Analyzing Feedback

Once feedback is collected, it is essential to analyze the data to identify common themes and areas for improvement. Quantitative data from rating scales can be quickly summarized, while qualitative data from open-ended questions can provide deeper insights.

2. Making Improvements

Based on the feedback analysis, businesses can make informed decisions to enhance their billing and payment processes. This could involve redesigning financial forms to make them more user-friendly, updating the pay bill format, or simplifying the request bill form.

Utilizing well-designed financial forms, such as finance forms and billing forms, ensures accuracy and consistency in financial dealings. Implementing these strategies can significantly simplify financial transactions, making the process smoother for both businesses and customers.

Conclusion

Utilizing well-structured financial forms and feedback systems is essential for improving financial transactions. Billing and payment feedback templates allow businesses to gather valuable insights, helping them refine their processes and enhance customer satisfaction.

By analyzing and acting on customer feedback, companies can streamline their operations, foster loyalty, and ensure smoother financial interactions. Ultimately, these tools not only boost efficiency but also contribute to long-term business growth.

Frequently Asked Questions

What Is A Financial Application Form?

A financial application form is a document used to collect necessary information from clients or customers applying for financial services. It ensures that all relevant details are captured accurately.

Why Is Feedback Post-Transaction Important?

Feedback post-transaction helps businesses understand customers’ experiences and identify areas for improvement. This can lead to enhanced services and increased customer satisfaction.

How Can A Billing And Payment Feedback Template Improve Financial Transactions?

A billing and payment feedback template allows businesses to gather insights from customers about their transaction experiences. This feedback can be used to refine processes and improve overall efficiency.

What Should Be Included In A Feedback Template?

A feedback template should include clear instructions, relevant questions, rating scales, open-ended questions, and an option for respondents to provide contact information if needed.

How Can Businesses Analyze Feedback Effectively?

Businesses can analyze feedback by summarizing quantitative data from rating scales and examining qualitative data from open-ended questions for common themes and insights. This helps identify specific areas for improvement.

Enhance Patient Care and NABH Compliance with LazyMonkey

LazyMonkey is your all-in-one solution for improving patient care, retaining more patients, and meeting NABH standards. Our powerful QR-based feedback tool enables you to capture real-time insights from patient feedback, discharge surveys, staff and doctor evaluations, and clinical research, while also streamlining inter-departmental communication.

Transform your healthcare facility today - reach out to us at hello@lazymonkey.in, or request a demo here!

Elevate Your Restaurant Experience with LazyMonkey

LazyMonkey’s QR-based feedback system helps you gather real-time insights from customers, track satisfaction levels, and enhance the dining experience. Get instant feedback on your menu, service, and ambience, and make data-driven improvements to boost repeat customers and reviews.

Improve your restaurant today – reach out to us at hello@lazymonkey.in, or request a demo here!

Empower Student Engagement and Campus Improvement with LazyMonkey

LazyMonkey offers a seamless way to gather student feedback, track satisfaction, and enhance campus life. From course evaluations to dorm feedback, our QR-based solution makes it easy to capture valuable insights and improve student retention.

Upgrade your university experience – contact us at hello@lazymonkey.in, or request a demo here!

Streamline Feedback and Drive Performance Across Your Enterprise/Franchise with LazyMonkey

Whether you manage one or multiple locations, LazyMonkey’s QR-based feedback system helps you gather real-time employee and customer feedback. Improve operational efficiency, track satisfaction, and make data-driven decisions to enhance brand consistency and growth.

Transform your franchise today – reach out to us at hello@lazymonkey.in, or request a demo here!

Enhance Customer Satisfaction and Service Standards in Banking with LazyMonkey

LazyMonkey empowers banks to capture real-time feedback from clients across branches. Improve customer experience, assess service quality, and ensure regulatory compliance with our QR-based solution, helping you retain clients and meet banking standards.

Elevate your bank’s customer care – contact us at hello@lazymonkey.in, or request a demo here!

Boost Customer Engagement and Mall Satisfaction with LazyMonkey

LazyMonkey’s QR-based feedback tool enables you to collect feedback from shoppers, track satisfaction, and enhance the mall experience. Gather insights on store services, cleanliness, and entertainment to create an unmatched customer journey.